Best way to do that is have them watch the DWP video then get them on 3 way call with me. Or your sponsor. Or an associate.

Agent James L. had prospect watch video Tues Nite and got him on 3 way Wednesday am EST early and prospect signed and showed in system by 1 pm PST yesterday. New Agent has bunch of x cited folks watching video.

It all starts with YOU. (And the video!)

Mike

**************

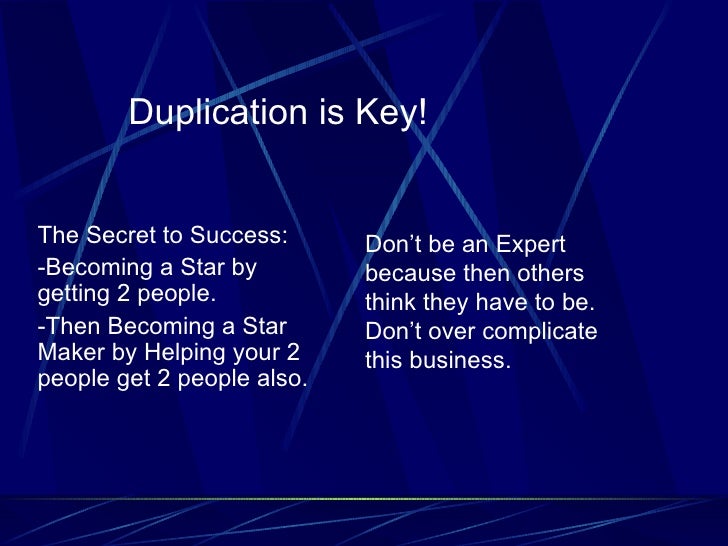

Then repeat.

Build your team of Agents and the Merchants will come.

****************

An Agent/Merchant Invites you to the charity fundraiser:

Contact Robinson Mangaoang

"CTC, a NON-PROFIT, invites you to this event. Sean and I got a table

space for our biz Digital World Pay. Aug.30 event it will be $20 dollars includesdinner and great entertainment. Please call me for tickets 408.876.9950"

*************

If you are talking with a merchant, this is a HANDY guideline for information that points to the BEST plan for him: download from the DWP section of your interface. Print off and keep handy!

**************

What Happens If I Swipe My Debit Card as ‘Credit’?

It’s a question we’ve all heard when shopping: “Credit or debit?”It seems straightforward, just the cashier asking you what type of payment card you’re using, but there’s actually a lot more history to that question than you might think.

Debit and credit transactions are processed differently:

Here’s how MasterCard explained it in an emailed statement to Credit.com: When

you use a debit card and your PIN (personal identification number), the

transaction is completed in real time, also known as an online transaction —

you authorize the purchase with your PIN and the money is immediately

transferred from your bank account to the merchant. With a credit

card, or using a debit card as credit, it’s an offline transaction.

“The funds for offline transactions are deducted after the merchant settles the purchase with the credit card processor and typically take 2-3 days to be reflected in your account balance,” MasterCard says.Issuers used to charge merchants different fees for accepting credit cards than for accepting debit card transactions with a PIN. Before the Dodd-Frank Wall Street Reform and Consumer Protection Act was passed, Sen. Dick Durbin added a provision, now called the Durbin Amendment, that restricted interchange fees to 12 cents per transaction. By the time the bill was signed into law, the cap was set at 21 cents, much lower than the previous average of 45 cents per transaction. (On Jan. 20, the Supreme Court declined to hear retailers’ challenge to that 21-cent cap.)

With the cap on interchange fees, banks saw their revenue source for things like debit card rewards and free banking dry up, which is why you’re unlikely to find those things these days.“There’s several thousand community banks and credit unions, what the act refers to as unregulated, who can actually charge greater interchange on transactions,” said Nick Barnes senior vice president of retail banking at ACI Worldwide, a payments system company. The Durbin Amendment only impacted financial service providers with $10 billion or more in assets. “That’s why you go to these tiny banks you’ll still see free banking and debit rewards.”

Should You Choose Debit or Credit?

Credit cards and debit cards are very different products, each with their own advantages and drawbacks that should influence when and how you use them. As for hitting the “credit” button when you’re using a debit card: It doesn’t really matter.Other than the changes banks may have made as a result changing interchange fees, choosing to use a debit card as credit doesn’t really impact you. You often have the choice to use your debit card with or without the PIN, and how you use it is a matter of personal preference. Running a debit card as an offline transaction still ends up doing the same thing — taking money from your checking account — and it doesn’t help you build credit, like using a credit card does.

***************

Have you used your DWP training? Tell me --- how much does a merchant pay to accept a debit card?

No comments:

Post a Comment